Buenavista Equity Partners, a Spanish private equity firm specializing in lower and mid-market segments, has unveiled its new healthcare-focused fund, BV Healthcare Growth Innvierte I. With an initial closing of €100 million, the fund has met its target size and aims to raise additional commitments to reach a hard cap of €150 million. This initiative is a joint venture between Buenavista and Columbus Venture Partners, a leader in biotech venture operations. Together, the two companies generally have made 45 investments in the healthcare sector.

The fund enjoys backing from Spain’s Centre for Technological Development and Innovation (CDTI), which has committed up to €58 million through its Innvierte Programme. This co-investment program supports the advancement of innovative therapies and drug development.

Healthcare Fund: Fund’s Vision and Investment Strategy

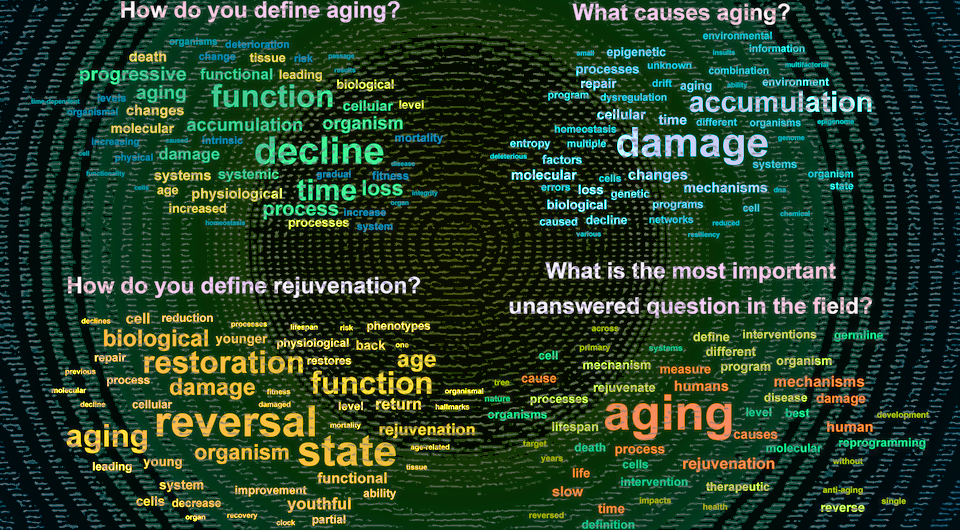

Nuria Osés, partner and head of healthcare strategy at Buenavista, expressed enthusiasm about the fund’s launch, highlighting its exclusive focus on the healthcare sector. “We’re entering a new growth phase with a strong commitment to a sector that offers immense potential. Not only because of its expansion capacity but also due to the rising demand for innovative solutions that require significant investment,” she said. The fund aims to support companies addressing major trends such as precision medicine, advanced therapies, the challenges of increased longevity, and the prevalence of chronic diseases. Beyond generating economic returns, these companies are focused on creating positive societal impacts by enhancing people’s quality of life.

Buenavista Equity Partners, established in 1996, currently manages over €1 billion across various private equity, infrastructure, and venture capital funds. Columbus Venture Partners adds over €400 million under management, with extensive experience in biopharmaceutical investments.

Therefore, the fund will focus on innovative healthcare startups with low scientific or technological risks or those near commercialization. So, the goal is to help these companies scale and grow, providing capital, expertise, and global reach to maximize their potential. Key areas of interest include pharmaceuticals, biotech products, precision medicine, diagnostic solutions, AI and big data in healthcare, digital therapies, industrial production scaling, scientific services (CROs and CDMOs), and healthcare services. The fund plans to invest in 10-12 companies, primarily in Spain, with individual investments of up to €15 million.

First Investment and Future Prospects

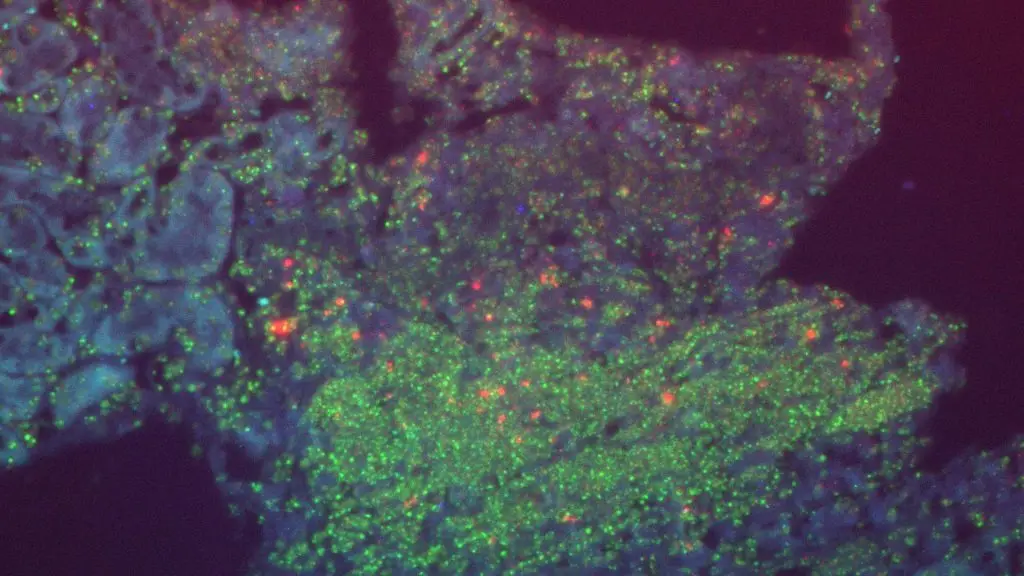

The fund’s first investment has been made in Syngoi, a Contract Development and Manufacturing Organisation (CDMO) specializing in synthetic DNA for advanced therapies, including mRNA vaccines and gene therapies. Syngoi, based in Zamudio, Bizkaia, uses advanced facilities to streamline DNA production, improving turnaround times and DNA purity. This investment, with contributions from Columbus and Asahi Kasei Medical, soon will enable Syngoi to expand its capacity and support over 25 concurrent customer projects.

Damià Tormo, Managing Partner and co-founder of Columbus Venture Partners, finally emphasized the strategic focus of the fund on healthcare and biotechnology companies at critical stages of development. “This fund addresses a gap in the financing of high-growth medical companies in Spain and the broader European market, providing essential capital for companies with scientifically proven, risk-free products,” Tormo stated.

More Longevity news.